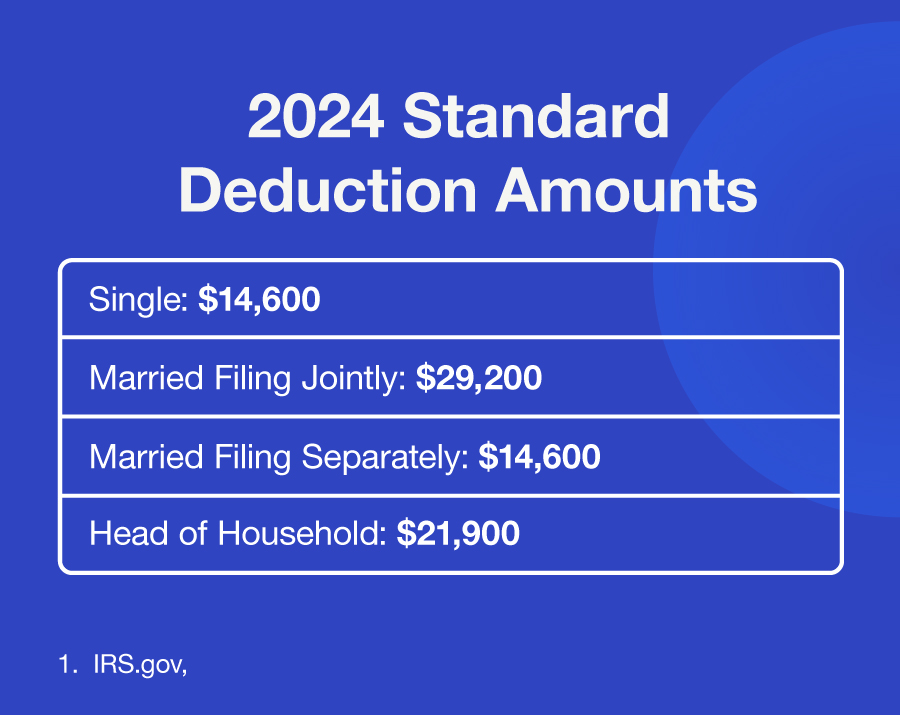

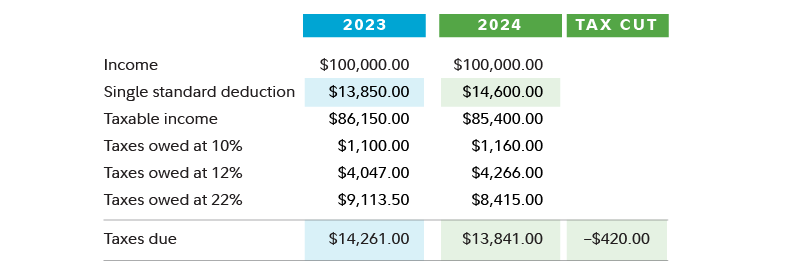

Schedule A 2024 Standard Deduction – For roughly 1 in 10 taxpayers, itemizing deductions — rather than claiming the standard deduction — is the better game plan. Here’s why. . An overwhelming majority of American taxpayers—about 90%—claim the standard deduction on their federal income tax return. And, for most of those people, the standard deduction is the largest tax .

Schedule A 2024 Standard Deduction

Source : www.forbes.comWhat’s My 2024 Tax Bracket? | 1847Financial New Jersey Headquarters

Source : www.primaryfinancial.netIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comTax brackets 2024| Planning for tax cuts | Fidelity

Source : www.fidelity.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comYour First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comStandard Deduction 2024 Amounts Are Here | Kiplinger

Source : www.kiplinger.comYour First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comUnderstanding the standard deduction in 2024 | CNN Underscored Money

Source : www.cnn.comSchedule A 2024 Standard Deduction IRS Announces 2024 Tax Brackets, Standard Deductions And Other : For tax year 2023 (tax returns due April 2024), the standard deduction is To claim your itemized deductions, you need to complete Schedule A, Itemized Deductions, of the Form 1040. That total is . Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)